Could You Get A $2,000 Tariff Check? Trump’s Dividend Idea Faces Congress And The Courts – Financial Freedom Countdown

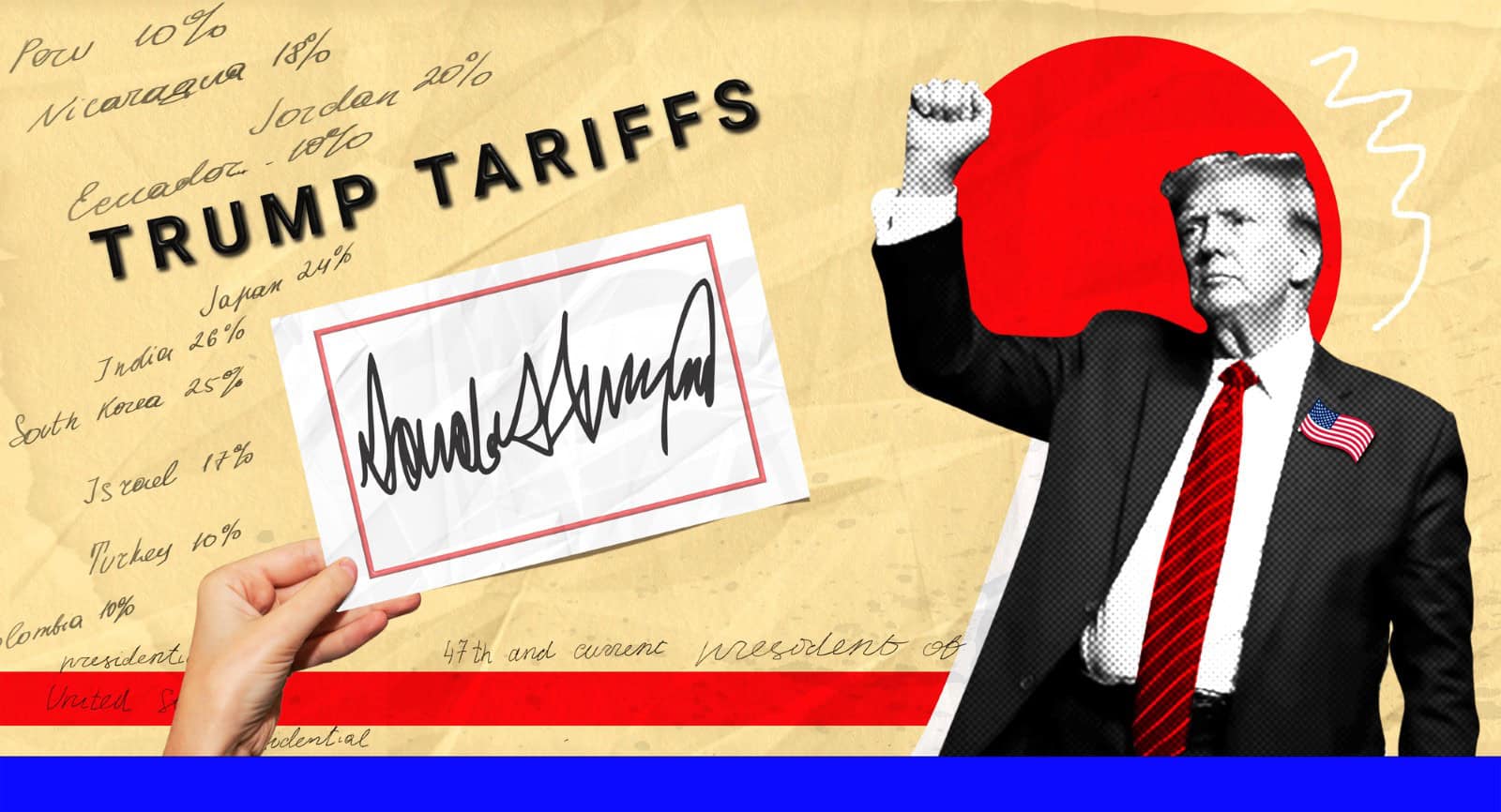

President Donald Trump said Thursday he is still considering giving Americans up to $2,000 in rebate checks tied to his sweeping tariff agenda.

The idea, which he described as a “dividend to the people of America,” would redirect a share of the hundreds of billions of dollars his tariffs have generated since going into effect this spring.

A Trillion-Dollar Tariff Vision

In an interview with One America News Network, Trump predicted tariffs would eventually bring in “over a trillion dollars a year.” He said the priority remains paying down the $37 trillion national debt, but added that distributing some of the revenue directly to the public is “on the table.” “We’re thinking maybe $1,000 to $2,000 – it would be great,” Trump said.

Hawley’s $600 Rebate Bill Already on the Table

While Trump is floating larger “dividends,” Senator Josh Hawley of Missouri has already introduced the American Worker Rebate Act, which would provide $600 per adult and dependent child. For a family of four, that would total $2,400. The measure, modeled on the pandemic-era stimulus checks, would gradually phase out for higher earners. Hawley argues that the tariff windfall should directly benefit working families, not just the Treasury.

Congressional Approval Required

Neither Trump’s $2,000 proposal nor Hawley’s $600 plan can move forward without congressional approval. Several Republicans have already voiced skepticism, citing inflation fears and the ballooning federal debt. Senator Rand Paul dismissed the idea as “ridiculous,” while Senator Bernie Moreno called it “insane” and potentially “extraordinarily inflationary.” Others, like Senator Ron Johnson, have said they would only support rebates if the government had a budget surplus.

Supreme Court Could Upend Tariff Revenues

Complicating the debate is an upcoming Supreme Court case that could decide whether Trump even has the authority to impose such sweeping global tariffs. Lower courts have found many of the levies illegal, though they remain in place while the administration appeals. Treasury Secretary Scott Bessent has warned the justices that a ruling against Trump could force the government to refund between $750 billion and $1 trillion in collected and projected tariff revenue.

Record Tariff Collections in 2025

Despite legal uncertainty, tariffs are pouring money into federal coffers. According to the Treasury Department, the government has collected about $214.9 billion in tariff revenue so far this year. September’s haul came in at $31.3 billion, slightly below August’s record but still one of the highest monthly figures on record. Bessent projects total revenues will top $300 billion by year’s end.

Trump’s Balancing Act: Debt vs. Dividends

The president insists that tariffs are first and foremost a tool to pay down the debt. “Number one, we’re paying down debt,” Trump said, “because people have allowed the debt to go crazy.”

Still, he has openly weighed distributing part of the funds to households, seeing it as a way to both share in America’s trade “victory” and reward working families.

Will Americans Actually See a Check?

Between Hawley’s $600 rebate plan, Trump’s $2,000 “dividend” idea, and the looming Supreme Court ruling, the future of tariff checks remains highly uncertain. Congress must approve any disbursement, and deep divisions within the GOP make passage an uphill climb. For now, Americans can only watch as Washington debates whether Trump’s tariffs become a tool for paying debt; or delivering the next wave of stimulus.

Like Financial Freedom Countdown content? Be sure to follow us!

Starting September 30, 2025, the Trump administration will end the use of paper checks for Social Security benefits, completing the Social Security Transition to Electronic Payments. While more than 99% of seniors are already set up electronically, a small group still receiving paper checks must act now to avoid payment delays. Beneficiaries who haven’t switched yet will need to enroll in direct deposit or request a Direct Express card to keep their monthly benefits arriving on time. This change is part of a broader government effort to reduce fraud, improve efficiency, and save taxpayer dollars.

Trump’s Social Security Upgrade Ends Paper Checks on Sept. 30. What Seniors Must Do Now

JPMorgan Sees 2026 Tax Refund Wave as Trump’s Law Takes Effect

A flood of larger tax refunds could arrive in early 2026, according to JPMorgan Asset Management’s chief global strategist David Kelly. The Internal Revenue Service announced it will keep withholding levels unchanged through 2025, even as Trump’s One Big Beautiful Bill Act (OBBBA) takes effect. That means workers won’t see extra cash in their paychecks this year; but will instead get it back when filing 2025 returns, likely boosting refund sizes. Kelly told clients that these bigger refunds “should work much like a new round of stimulus checks,” adding to household cash flow just as the new year begins. He said the refund surge could give consumer demand a short-term lift, while also shaping how markets digest the policy shift.

JPMorgan Sees 2026 Tax Refund Wave as Trump’s Law Takes Effect

Elizabeth Warren Targets Job Credit Checks, Says They Discriminate Against Workers

Senator Elizabeth Warren of Massachusetts and Representative Steve Cohen of Tennessee reintroduced legislation aimed at banning employers from using credit reports when making hiring decisions. The move comes as U.S. workers face increasing pressure in a slowing labor market.

Elizabeth Warren Targets Job Credit Checks, Says They Discriminate Against Workers

John Dealbreuin came from a third world country to the US with only $1,000 not knowing anyone; guided by an immigrant dream. In 12 years, he achieved his retirement number.

He started Financial Freedom Countdown to help everyone think differently about their financial challenges and live their best lives. John resides in the San Francisco Bay Area enjoying nature trails and weight training.

Here are his recommended tools

Personal Capital: This is a free tool John uses to track his net worth on a regular basis and as a retirement planner. It also alerts him wrt hidden fees and has a budget tracker included.

Platforms like Yieldstreet provide investment options in art, legal, real estate, structured notes, venture capital, etc. They also have fixed-income portfolios spread across multiple asset classes with a single investment with low minimums of $10,000.